Community Investment: “Why You Don’t Have To Invest Alone”

Welcome to a detailed exploration of the strategic advantages of investing in luxury real estate, inspired by the insights from “The IModern Experience Podcast.” In this episode, we delve into why high-net-worth individuals and savvy investors are turning to luxury properties as a key component of their investment portfolios. From the stability and growth potential these properties offer to the unique tax benefits and portfolio diversification opportunities, luxury real estate stands out as a wise investment choice.

The Allure of Long-term Value Appreciation

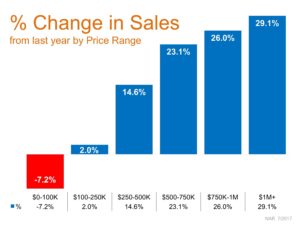

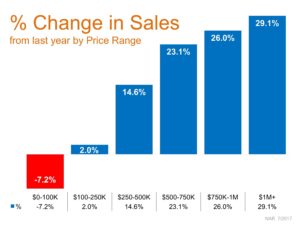

Historical Trends and Market Analysis

Luxury real estate has historically demonstrated strong long-term value appreciation. In top markets like New York, London, and Hong Kong, luxury properties have not only retained their value but have also seen significant growth. For instance, reports from Knight Frank highlight that luxury properties in these cities have appreciated by an average of 5% to 10% per year over the past decade. This trend underscores the robust nature of high-end real estate investments in maintaining and increasing their worth over time.

Expert Insights and Future Outlook

The future of luxury real estate looks promising, thanks to a combination of economic stability, demand for high-end living, and the scarcity of available properties in prime locations. According to industry experts like James Langton, a seasoned real estate analyst, the luxury market is expected to continue its upward trajectory, particularly in emerging markets like Dubai and Singapore. These insights suggest that investing in luxury properties can be a prudent decision for those looking to capitalize on future real estate trends.

Tax Advantages of Luxury Real Estate Investment

Tax Breaks and Benefits

One of the compelling reasons to invest in luxury real estate is the range of tax advantages it offers. Investors can benefit from deductions for mortgage interest, property taxes, and significant depreciation. These benefits not only reduce the overall taxable income but also enhance the profitability of the investment. For luxury real estate investors, understanding how to leverage these tax benefits can lead to substantial financial gains.

Strategic Tax Planning

Effective tax planning is crucial for maximizing the returns from luxury real estate investments. By strategically timing the purchase and sale of properties and utilizing options like 1031 exchanges, investors can defer capital gains taxes, thereby optimizing their investment’s growth potential. Consulting with tax professionals who specialize in real estate can provide investors with tailored strategies that align with their financial goals.

Diversifying Your Portfolio with Luxury Real Estate

Risk Management Through Diversification

Diversification is a key strategy in managing investment risk, and luxury real estate plays a significant role in this regard. By incorporating high-end properties into their portfolio, investors can protect themselves against the volatility of more traditional investments like stocks and bonds. The inherent stability of luxury real estate, driven by its limited supply and consistent demand, makes it an excellent choice for diversification.

Inflation Hedging Properties

Luxury real estate is also an effective hedge against inflation. As inflation rates increase, so too do property values and rental rates, which can provide investors with increased returns that keep pace with or exceed the rate of inflation. This characteristic makes luxury real estate an attractive investment for preserving the purchasing power of capital in times of inflationary pressure.

The Role of Real Estate in Wealth Preservation

Long-term Security and Stability

Investing in luxury real estate offers not just financial returns but also long-term security and stability. Properties in premium locations are less susceptible to market fluctuations, maintaining their value over time and providing a safe haven for capital. For families looking to preserve wealth across generations, luxury real estate is a reliable and tangible asset that can serve as a cornerstone of their financial legacy.

Case Studies of Successful Investments

Real-world examples of families and individuals who have successfully preserved and grown their wealth through luxury real estate investments further validate its effectiveness. These case studies highlight how strategic investments in luxury properties have led to substantial wealth accumulation and security, reinforcing the value of real estate in a well-rounded investment portfolio.

Conclusion and Call to Action

Investing in luxury real estate offers a multitude of benefits, from significant value appreciation and robust tax advantages to portfolio diversification and inflation protection. As we’ve explored in this detailed discussion inspired by “The IModern Experience Podcast,” the strategic advantages of such investments are clear.

If you’re inspired to start or expand your journey in luxury real estate investment, we invite you to learn more and explore available opportunities. Visit IModernLuxury.com to browse our exclusive listings and tune into our podcast for more insights on maximizing your investment potential. Join us at IModern Wealth Investment Club to connect with a network of premier professionals and start building a legacy of wealth with luxury real estate today.